Not known Details About Hard Money Atlanta

Wiki Article

The Buzz on Hard Money Atlanta

Table of ContentsA Biased View of Hard Money AtlantaThe Best Strategy To Use For Hard Money AtlantaSome Of Hard Money AtlantaThe Basic Principles Of Hard Money Atlanta Unknown Facts About Hard Money Atlanta

, are temporary loaning instruments that actual estate financiers can utilize to finance a financial investment project.There are two primary downsides to consider: Difficult cash fundings are convenient, however financiers pay a rate for borrowing this way. The rate can be up to 10 percent points greater than for a standard lending. Origination costs, loan-servicing fees, and also closing expenses are also likely to set you back financiers a lot more.

Little Known Questions About Hard Money Atlanta.

You might have the ability to tailor the settlement schedule to your requirements or obtain specific fees, such as the source charge, minimized or gotten rid of during the underwriting process. With a difficult money car loan, the building itself typically functions as collateral for the loan. But again, lenders may enable investors a bit of leeway here.

Tough money financings are a great fit for wealthy capitalists that need to get funding for an investment residential property quickly, with no of the bureaucracy that accompanies bank financing (hard money atlanta). When examining difficult money lenders, pay attention to the costs, rate of interest, and finance terms. If you wind up paying excessive for a hard money loan or cut the payment duration as well brief, that can affect how profitable your actual estate venture is in the long term.

If you're wanting to buy a residence to flip or as a rental building, it can be testing to obtain a conventional mortgage - hard money atlanta. If your credit scores score isn't where a standard loan provider would certainly like it or you need money faster than a lender is able to offer it, you can be unfortunate.

The Basic Principles Of Hard Money Atlanta

Tough cash loans are temporary guaranteed car loans that use the building you're purchasing as security. You won't discover one from your bank: Difficult cash financings are offered by alternate lending institutions such as individual capitalists as well as exclusive firms, who usually ignore sub-par credit report as well as various other economic factors and also rather base their choice on imp source the residential or commercial property to be collateralized.Difficult money loans supply several benefits for borrowers. These include: From beginning to finish, a hard money funding may take just a few days.

While tough money financings come with benefits, a debtor must also think about the threats. Amongst them are: Tough cash loan providers typically bill a greater rate of interest price since they're assuming even more risk than a conventional lending institution would certainly.

All about Hard Money Atlanta

All of that amounts to imply that a difficult cash financing can be an expensive way to obtain cash. hard money atlanta. Making a decision whether to obtain a difficult money financing depends in large part on your circumstance. All the same, be certain you consider the dangers and also the costs before you join the populated line for a hard cash financing.You absolutely do not wish to lose the lending's security because you weren't able to stay up to date with the regular monthly settlements. Along with shedding the property you place ahead as collateral, back-pedaling a tough money funding can cause significant credit rating injury. Both of these outcomes will certainly leave you worse off financially than you were in the first placeand might make it much harder to borrow again.

An Unbiased View of Hard Money Atlanta

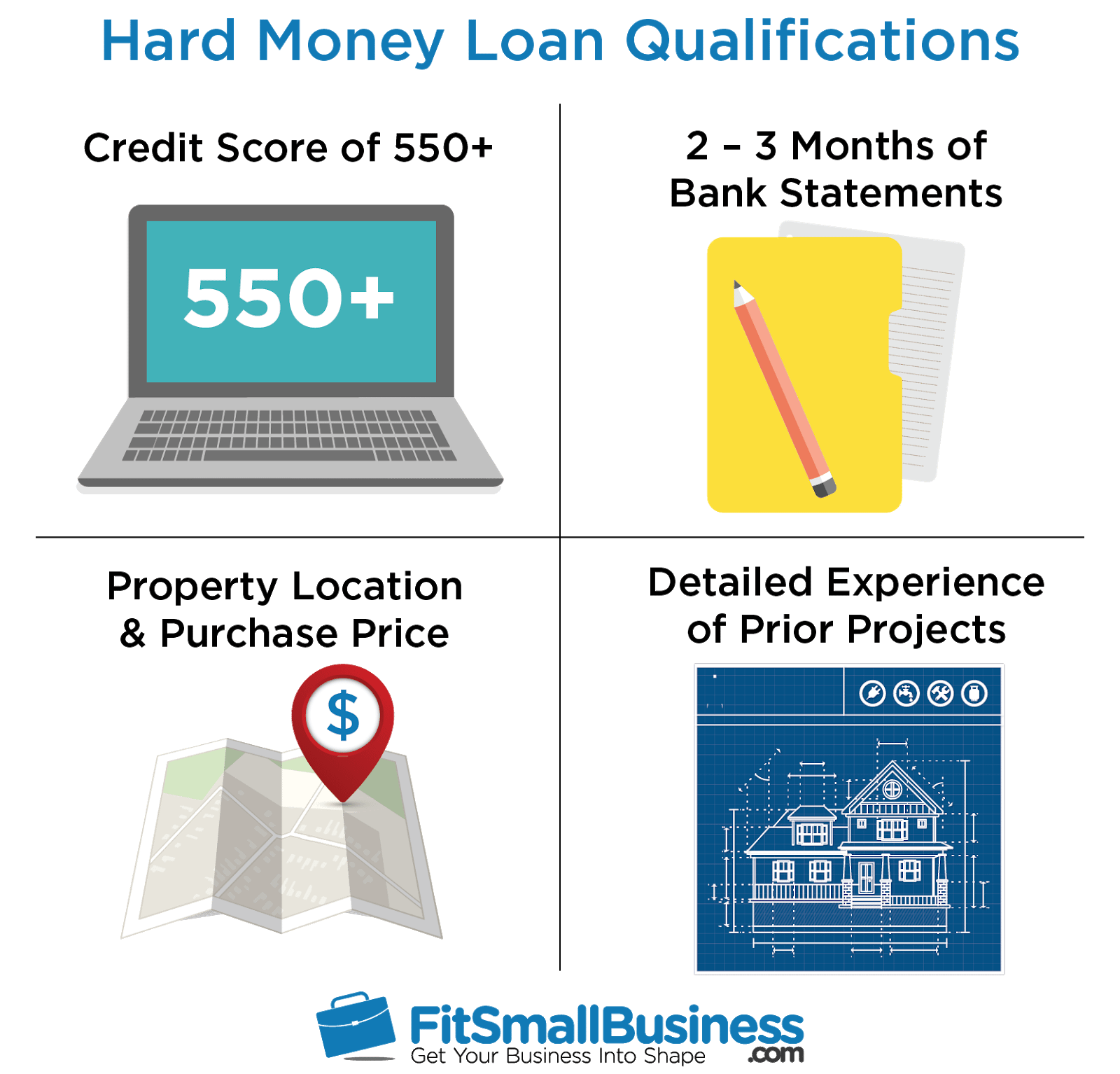

It's crucial to consider factors such as the loan provider's credibility and also rate of interest. You might ask a trusted actual estate agent or a fellow home flipper for referrals. Once you've nailed down the best difficult money lending institution, be prepared to: Generate the down payment, which typically is heftier than the down payment for a traditional mortgage Gather the necessary paperwork, such as evidence of income Possibly work with an attorney to review the terms of the funding after you have actually been approved Draw additional resources up an approach for repaying the loan Equally as with any car loan, assess the benefits and drawbacks of a tough cash financing prior to you commit to borrowing.No matter what kind of lending you choose, it's probably an excellent concept to check your free credit history and totally free debt report with Experian to see where your financial resources stand.

When you listen to words "tough money funding" (or "private cash financing") what's the first thing that goes with your mind? Shady-looking loan providers who conduct their business in dark streets and also fee sky-high interest rates? In prior years, some bad apples other stained the tough money lending sector when a few predacious lenders were attempting to "loan-to-own", giving really high-risk lendings to customers using property as collateral and also planning to seize on the residential or commercial properties.

Report this wiki page